With Merger Scrapped, Tribune a Target Again

Station groups and broadcast networks hungry for scale are expected to line up for Tribune Media in the wake of the broadcaster’s decision to toss its $3.9 billion Sinclair Broadcast Group merger on the scrap heap.

Tribune said Aug. 9 that it would terminate the merger, mainly because of frustrations with Sinclair’s behavior during the approval process. Tribune also filed suit in Delaware Chancery Court Aug. 9 seeking $1 billion in damages from Sinclair, claiming the broadcaster breached its contract by failing to disclose key information regarding divestitures and unnecessarily bogging down the review process.

Tribune cited Sinclair’s “unnecessarily aggressive and protracted negotiations” with regulators, its refusal to sell stations that would have helped obtain approval and self-serving divestiture structures that helped diminish the merger in the eyes of the government.

Sinclair: ‘We Did Not Mislead’

Sinclair put out a statement saying it was disappointed the deal was over and blamed the FCC review process, but said Tribune’s lawsuit had no merit.

“We unequivocally stand by our position that we did not mislead the FCC with respect to the transaction or act in any way other than with complete candor and transparency,” Sinclair CEO Christopher Ripley said.

While litigation likely goes through the court system over the next several months, Tribune is expected to draw a lot of attention from other broadcasters, hungry to bulk up in the new media broadcasting ecosystem.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

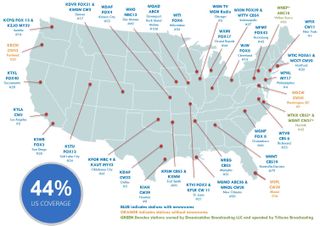

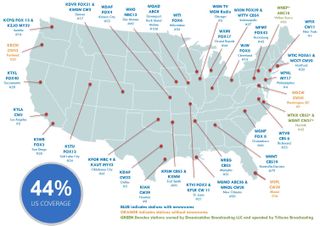

Tribune has about 42 stations in 33 markets, including WPIX New York, KTLA Los Angeles, WGN Chicago, KPCQ Seattle and KTVI and KPLR St. Louis, as well as cable network WGN America, multicast networks Antenna TV and ThisTV, global web properties and metadata businesses.

21st Century Fox, which has agreed to sell most of its cable and studio assets to The Walt Disney Co. — with its broadcast, news and sports assets joining a new company tentatively named New Fox — has been speculated as a prime candidate to purchase the Tribune stations.

Tribune has about 14 Fox affiliates in markets the broadcaster has coveted for years, and could sell off the rest to third parties.

Fox has already expressed a desire to bulk up on stations. It originally agreed to buy seven stations from the combined Sinclair-Tribune, but that avenue is apparently closed off now.

With its new structure after the Disney transaction closes early next year, Fox is expected to be aggressive on the deal front.

Fox officials declined to comment on speculation around Tribune. But Fox has coveted certain Tribune stations, like affiliate KCPQ Seattle, for years. “They have always wanted Seattle because of the NFC rights and Seahawks games,” said one industry executive familiar with Fox, adding that WSFL, Tribune’s Miami CW affiliate, could also be attractive to the broadcaster as a flip opportunity: Sunbeam Television’s WSVN is the Fox affiliate in that market, but that agreement could eventually be unwound.

Fox would probably prefer to own stations in NFL towns with National Football Conference teams (Fox airs NFC games during the season), but stations in large markets don’t come to the table often.

“Denver is a nice get,” said the executive who asked not to be named. “Any markets with a Fox affiliate and an NFL football team are prime targets.”

Weighing in the NFL and other factors, top Tribune station targets for Fox could include the seven stations that were part of the earlier deal (Seattle; Denver; Cleveland; Miami; Sacramento and San Diego, Calif.; and Salt Lake City) and Tribune’s other Fox affiliates in St. Louis; Indianapolis; Milwaukee; Kansas City; Harrisburg, Pa.; Hartford, Conn.; and Greensboro, N.C.

Fox already owns 28 TV stations in 17 markets, covering 37% of U.S. television homes. They include seven duopolies in the top 10 markets: New York, Los Angeles, Chicago, Dallas, San Francisco, Washington, D.C. and Houston. Fox also owns duopolies in Minneapolis, Phoenix, Orlando and Charlotte.

Executive chairman Rupert Murdoch told analysts in December that adding stations would “give us greater strength in getting clearances.”

‘Unlikely’ to Be Independent Long

Fox isn’t the only potential suitor. In a research note, Evercore ISI broadcast analyst David Joyce said Tribune is expected to attract a wide variety of interest.

Tribune, Joyce wrote in a research note, is “unlikely to remain independent for long. We believe Tribune management has positioned the company to be a seller.”

Joyce reminded investors that Tribune’s proxy statement on the deal revealed a four-month bidding war for the company, which ended with Sinclair increasing its bid to $43.50 per share (from $32.90 originally) after Nexstar Media Group made five counter-offers.

Other participants included six other broadcasters (like 21st Century Fox, in partnership with Blackstone Group) and six private-equity funds.

“For these reasons, we believe there would be no shortage of potential buyers if Tribune ultimately again comes to market,” Joyce wrote.